Understanding dental insurance coverage for emergencies is vital. Emergency care includes severe toothaches, broken teeth, and oral bleeding, with procedures like extractions and root canals covered. Routine exams are usually covered but immediate interventions take priority over non-essential treatments. Reviewing policy details is crucial, especially for long-term solutions like implants. Confirming that a facility accepts your dental insurance plan is key to managing costs in an emergency.

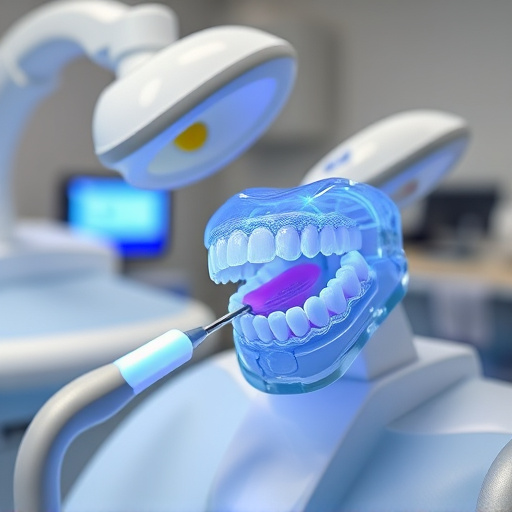

Are you prepared for unexpected dental emergencies? Understanding your dental insurance coverage is crucial when facing painful situations. This article guides you through the process, ensuring you make informed decisions during critical moments. We explore what constitutes an emergency dental service and provide tips to maximize your benefits. Knowing your policy’s scope can mean faster, more affordable care when every minute counts. Discover how to navigate this process effectively and choose the right coverage for peace of mind.

- Understanding Dental Insurance Coverage for Emergencies

- What Qualifies as an Emergency Dental Service?

- Maximizing Your Benefits: Tips for Emergency Care

Understanding Dental Insurance Coverage for Emergencies

When it comes to dental emergencies, understanding your insurance coverage is crucial. Many dental insurance plans are designed to provide comprehensive care, including urgent and emergency services. Dental insurance accepted for emergency services ensures that you can access vital treatments without incurring substantial out-of-pocket expenses. This coverage typically includes procedures such as tooth extractions, root canals, and dental fillings when they are deemed necessary due to an injury or acute dental issue.

Knowing the specifics of your plan is essential. Some policies may have limitations on emergency care, especially if it involves non-essential treatments like clear aligners or cosmetic procedures. Routine oral exams are generally covered as a preventive measure, but immediate interventions for severe conditions often take precedence. Dental implants, while valuable long-term solutions, might be categorized differently under various plans, so reviewing your policy is key to navigating emergency dental care efficiently.

What Qualifies as an Emergency Dental Service?

When it comes to dental insurance coverage, understanding what constitutes an emergency service is key for policyholders. Emergency dental care refers to urgent situations that require immediate attention and treatment. These can include severe toothaches, broken or cracked teeth, oral bleeding, swollen gums, and mouth infections. For instance, a sudden, sharp pain in a tooth that prevents chewing or biting could be considered an emergency, especially if it’s accompanied by swelling or intense sensitivity.

Common procedures like dental fillings and wisdom tooth removal are often covered under dental insurance plans when deemed necessary for relief from dental discomfort or potential health risks. Even issues related to children’s dentistry, such as teeth grinding (bruxism) or traumatic injuries during sports activities, can qualify as emergencies. Policyholders should review their specific plan details to ensure they understand what is covered and how to access emergency dental services while leveraging their dental insurance benefits.

Maximizing Your Benefits: Tips for Emergency Care

When facing an emergency dental situation, understanding your dental insurance coverage and maximizing its benefits can make a significant difference in both cost and accessibility of care. The first step is to confirm with your provider that the facility offering emergency dental services accepts your dental insurance plan. This ensures a smoother process and prevents any unexpected financial burdens.

Knowing what constitutes an ’emergency’ under your policy is crucial. Most dental plans cover sudden issues like severe toothaches, abscesses, or oral injuries. For procedures like wisdom tooth removal or children’s dentistry, check if these are included in your benefits, as some plans may have specific exclusions. Remember to also inquire about any waiting periods for pre-existing conditions and understand what kind of documentation you need to provide for reimbursement, including receipts for dental fillings if needed.

Dental insurance accepted for emergency services can significantly alleviate financial stress during unforeseen oral health crises. By understanding your coverage, identifying qualifying emergencies, and strategically maximizing benefits, you can ensure prompt and affordable care. Remember, knowing your policy’s specifics empowers you to navigate unexpected dental issues with confidence and peace of mind.